Financial Planning and Analysis

Our FP&A services, underpinned by our extensive financial and analysis expertise, deliver tailored financial management services that are pivotal in strategic planning, budgeting, and performance management through KPIs. We ensure profitability and assist in optimizing working capital, bolstered by fundraising advisory and profit maximization initiatives that aim to achieve targeted business valuation and attract investors, thereby enhancing growth equity opportunities.

Our Objective

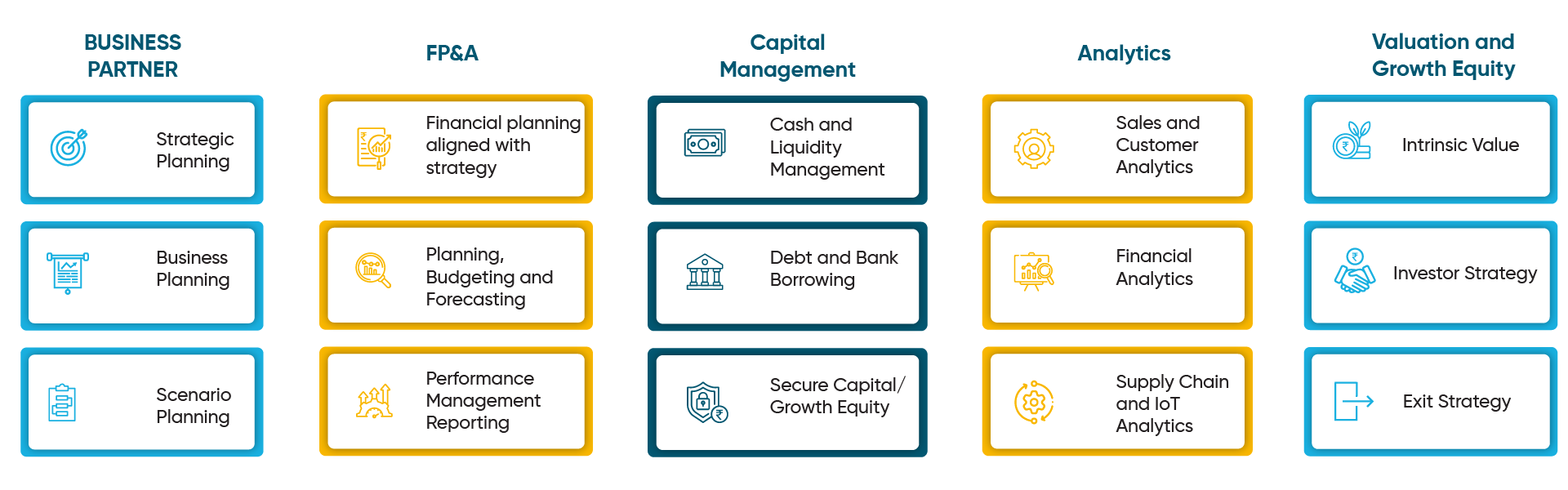

Fintelligence Consultants Financial Planning & Analysis Framework

- We offer FP&A services aligned with your business strategy and tailored to your unique needs.

- Our services go beyond the standard, enhancing performance and creating value through careful planning, improved efficiency, and ensuring increased competitiveness and long-term sustainability for your business.

- We assist clients in identifying, prioritizing, and implementing short-term, medium, and long-term opportunities, instilling a sense of optimism about the potential for sustainable business success.

Fintelligence Consultants Business Partner Approach

Profit Maximization

Revenue enhancement and Margin Expansion are not just strategies but the principal routes to financial success. Revenue enhancement is through pricing strategies, and Margin expansion is through reducing the COGS ratio, cost optimization, and effective operating leverage. We assist you in driving revenue (Commercial Strategy) and establishing a margin management framework (Processes & Tools) without compromising the service levels.

Fintelligence Consultants Gross Margin Management Framework.

Cash Flow and Working Capital

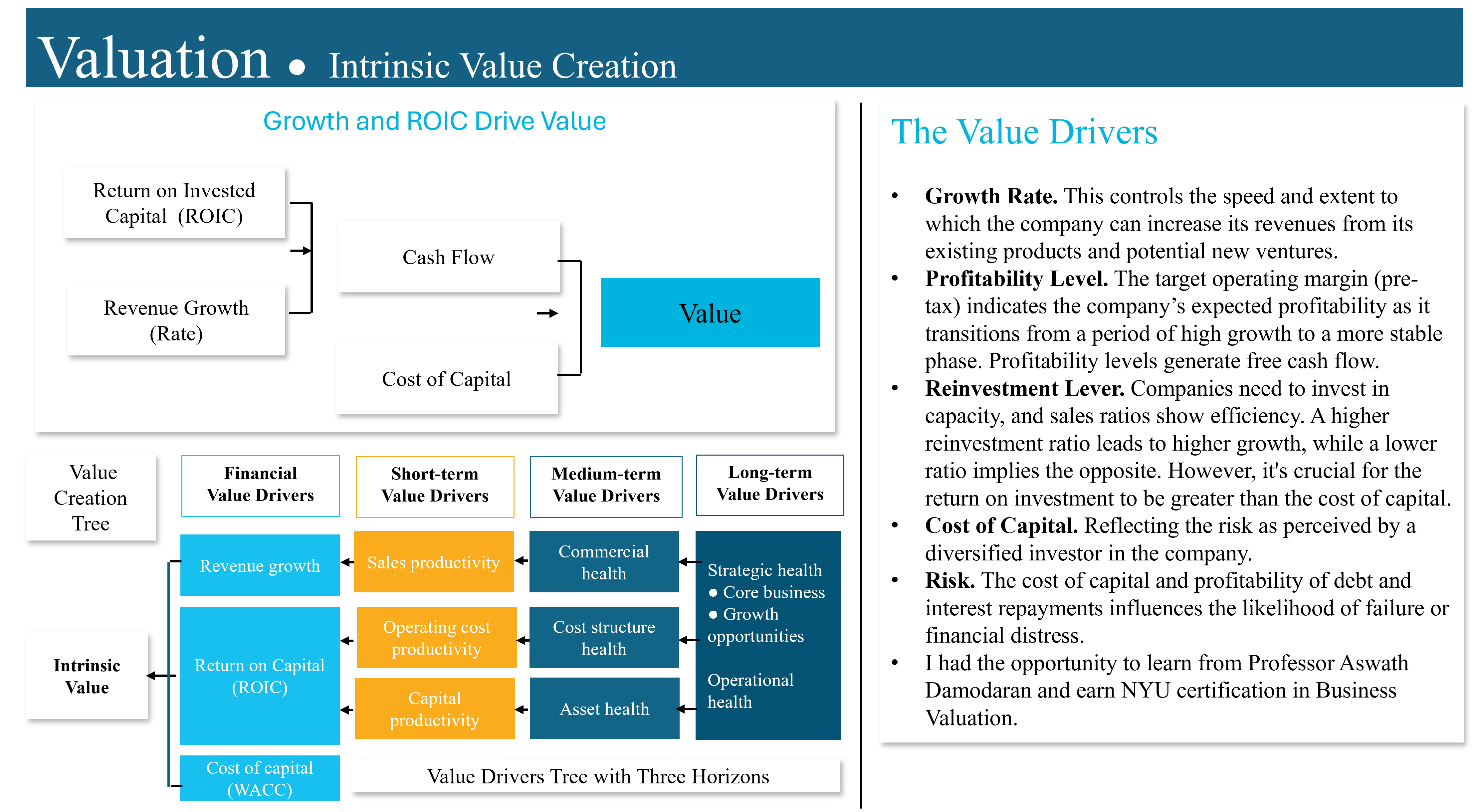

Valuation, Value Creation, and finding out Intrinsic Value

Valuation is a crucial tool in business, providing a reference point for assessing a company’s worth. A business’s value is determined by its fundamental characteristics, earnings growth, and potential cash flow generation. Our expertise can help you identify intrinsic value and enhance value, whether you are looking to attract investors or planning to exit your business at some point.

Growth Equity

With the support of growth equity investors, you can unlock the potential for remarkable revenue growth and operational improvement. Our FP&A expertise in financial planning and analysis can help craft a compelling mid-term business plan that resonates with investors and propels substantial growth. We can assist you in preparing a business plan that showcases your growth potential and attracts the right investors to help you achieve it.

A Value Creation Plan, or Strategic Business Plan in layperson’s terms, is a valuable tool for attracting investors. We consider the investor’s perspective while creating the plan and advising the client.

Performance Management

Value-led Growth or Growth-led Value Creation

Fundamental principles of corporate finance

Companies create value by investing capital to generate future cash flows at return rates exceeding their cost of capital. The faster they can grow and deploy more capital at attractive rates of return, the more value they create. The mix of growth and return on invested capital (ROIC) relative to the cost of capital drives value creation. This principle results in the conservation of value: any action that doesn’t increase cash flows doesn’t create value.

- The principles imply that a company’s primary task is to generate cash flows at the return on invested capital rates more significant than the cost of capital.

- Following these principles helps managers decide which investments will create the most value for shareholders in the long term.

- The principles also help investors assess the potential value of alternative investments.

- Managers and investors alike need to understand in detail what relationships tie together:Cash flows, ROIC, and value.

- How to factor any risks to future cash flows into their decision-making.

A good strategy starts with setting suitable targets.

- Market context

- Have I sufficiently outlined my business and comprehended the overall market and industry?

- Do I thoroughly understand the factors driving growth and profitability?

- Margin performance

- Is the current business operating at its maximum potential?

- Are the set targets realistic and strategically aligned to help the business achieve and maintain its full potential?

- Growth opportunities

- Are we making the most of our resources and goals to drive the company’s growth in revenue and profit?

- Investor Alignment

- Are my company’s achievements being acknowledged adequately by investors? Are market value and intrinsic value in harmony?

- Do I comprehend the expectations of the capital markets for my business?

Fundraising Advisory

Business and Executive Coaching and Competence Focus

Thoughtful execution and continual improvement are crucial to ensuring sustainable business results. We prioritize our clients by offering complimentary business coaching, tailored competency development, process support, tool support, and mentoring to help them achieve and maintain their desired outcomes.