Financial Planning and Analysis

Virtual CFO

Profit Maximization

Cash Flow and Working Capital

Growth Equity and Valuation

Fundraising Advisory

Business and Executive Coaching and Competence Focus

Objective

How Do We Help?

We aim to empower our clients to address various concerns in decision-making while focusing on strategic objectives. We understand the challenges you face and are here to provide strategic solutions that put you in control of your business’s future.

- How can we gain visibility and control to achieve our forecasted revenue and profitability? Are there opportunities to redesign processes and execute our budget with an efficiency mindset?

- What strategic path should our company take to drive organic growth? Is there still an opportunity in the core business, or should it be moved into adjacent businesses? How can we measure the full potential of the business?

- How difficult is the M&A path? What M&A strategy is suitable for my business?

- What initiatives are needed to achieve strategic objectives? Is there a best practice that can be implemented in the organization?

- Is it possible to take adequate measures towards working capital improvement and stabilize liquidity? What is the best way to generate positive cash flow?

- How can a business achieve profitable growth? Does profit maximization hurt customers and service levels?

- What levers can improve profitability considering revenue and cost/expense optimization?

- What is the actual profitability of our business and its product lines? How can we measure customer profitability? Can it be possible to measure and enhance individual customer profitability?

- Is the Gross margin ratio a good indicator of profitability? What is EBITDA?

- What does the Gross Margin Ratio tell?

- How can you effectively monitor and improve GM?

- Which customers and products generate the highest and lowest GM?

- What is the best way to evaluate the performance of each product line?

- Can you identify the best practices for overperforming business units to improve

company-wide performance? - How is your sales team performing regarding selling price and volume?

- What measures are required to make my business attractive to investors and lenders? Does it assist in achieving the fundraising objective? What is growth equity, which is used to create business opportunities?

- Does the business plan improve the bank funding facility opportunity? Does it address the bank’s concerns about creditworthiness and credit rating issues and getting assured and quicker approvals?

- How do we establish governance? Does that complement organizational growth and attract lenders and investors? Do we lose control and business decision-making with independent director appointments?

- What is finance excellence? Can there be specific functional excellence?

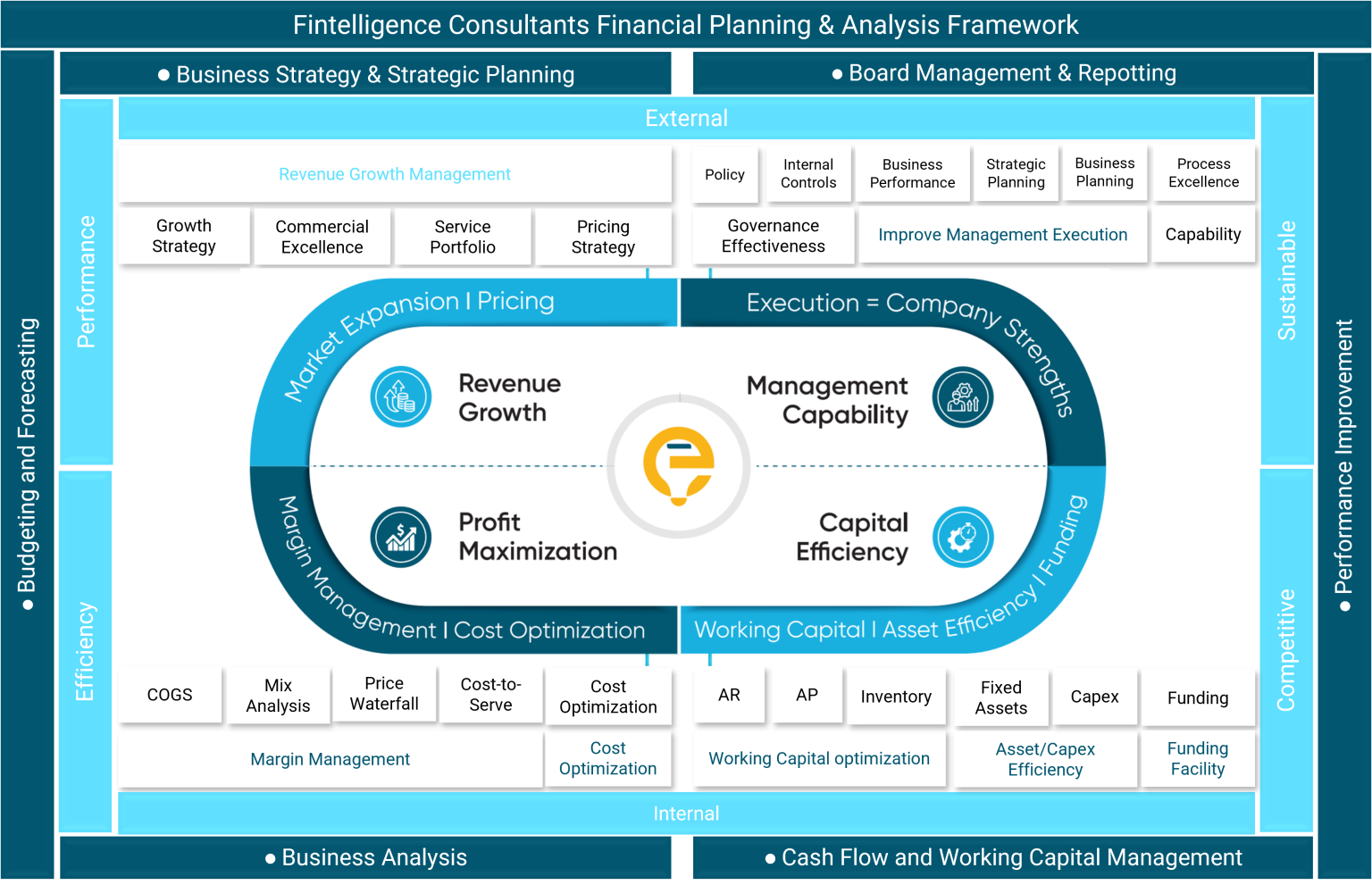

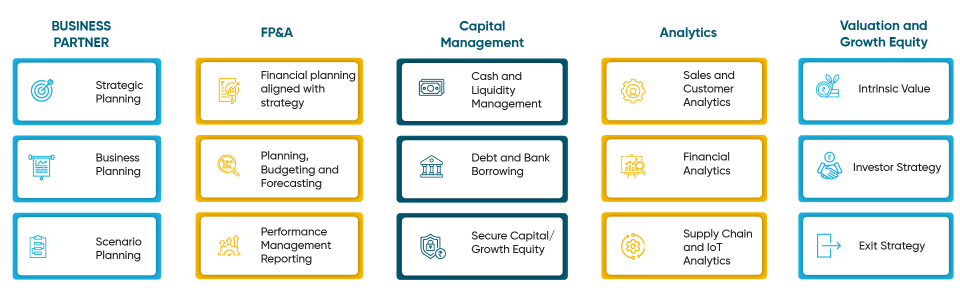

We offer a unique value proposition and an integrated business solution for sustainable growth.

What is our scope of services?

Why Choose Us?

Cross-Functional Catalyst Approach

Tailor Made Solutions

Business Partner Role

Execution Guidance

“Without strategy, execution is aimless. Without execution, strategy is useless.” Most organizations fail in execution. The entire organization needs to apply a similar scientific approach to what operational excellence has brought to the operations.

How Do We Help?

Profit Maximization

Sustainable profit improvement strategies can significantly enhance a business’s value and shareholder return. Highly profitable companies have untapped growth potential. The two principal routes to profitability optimization are revenue enhancement and margin expansion.

Revenue enhancement involves pricing strategies, boosting demand through marketing, and creating new goods or services. Margin expansion includes reducing the COGS ratio, cost optimization, and effective operating leverage. Eliminating discounts is an easy way to improve profitability.

What are the drivers of Profit Maximization?

- Revenue enhancement drives top-line growth by addressing pricing that enables Gross Margin volume.

- Margin expansion through effective pricing management involves identifying cost- to-serve, benchmarking market pricing and competitors, and managing and passing on the inflationary pressure.

- Decreasing the COGS ratio through a tactical analysis of every expense and how these can be cut, optimized, and synergized.

- Cost optimization isn't just about cutting expenses; it's a strategic move that can lead to higher returns and deter competitors. By operating at a low cost and increasing productivity, your business can gain a competitive edge in the market.

- Sufficient operating leverage utilizes fixed costs to boost profitability by magnifying the impact of sales fluctuations.

- Analysing margins for a company with multiple products can be complicated due to various factors affecting margin changes. Different products have different margin drivers, such as price, cost, and volume. A mix analysis tool can simplify understanding margin drivers.

- Increasing revenue, improving margins, and driving profitability are crucial for value creation.

We assist you in driving revenue through our commercial excellence portfolio and establishing an extensive margin management framework that enables Processes and tools without compromising service levels.

Our margin management framework comprises twenty factors that could deteriorate the gross margin.

Cost Optimization

Adopt a consistent cost management framework. This tool reflects the kind of framework

that business stakeholders need to create a prioritized list of promising cost optimization opportunities. It weighs various factors, from financial benefits to the impact on employee experience.

Cost Optimization Benefits and Impact

Strategic Relevance

- How critical is the opportunity to achieve the strategic goals?

- How well does this opportunity align with our organization’s opportunity?

Cost Savings and Productivity Gains

- How much is the savings on this cost optimization opportunity?

- How does the opportunity affect the organization’s productivity?

Business Impact

- What impact will this opportunity have on business outcomes?

- How does this opportunity affect the business’s day-to-day operations?

Impact on the Employee Experience

- What impact will this opportunity have on employee experience?

- How does this opportunity affect employees’ day-to-day work?

Investment, Time, and Risk

Investment Requirement

- Does the opportunity require significant, upfront investment before savings can be realized? Is the organization willing to invest at all? And if so, how can investments be minimized?

Time Requirement

- What is an acceptable time frame to realize savings?

- What prerequisites must be met to realize cost savings within the set time frame?

Risk Exposure

- What is the degree of organizational risk involved (staff reduction, changes in organizational relationships (cross-functional relationships, value chain partnerships, etc.?)

Stakeholder Buy-in

- Will key stakeholders such as business leaders, functional leaders, and the CFO sponsor and support the opportunity?

- Does this opportunity risk damaging the relationship with the business?

Cash Flow and Working Capital

Enhancing cash flow is vital for sustaining operations and driving business growth. External factors, including customer demand and supplier dynamics, significantly impact the cash conversion cycle. Our tailored approach helps establish robust policies, efficient processes, tools, and competence development to minimize working capital consistently.

Working Capital Importance

- In the past decade, external market forces have significantly changed the business landscape.

- Access to capital will remain tight for the foreseeable future. Working capital optimization is a critical priority for companies.

- A structured approach is necessary to achieve sustainable working capital

improvements. - Companies must understand the internal and external factors influencing working capital performance, use industry insights to benchmark performance, and guide action plans.

Cash Conversion Cycle (CCC)

Managing a company’s cash conversion cycle (CCC) components can help improve its working capital. This includes reducing inventory levels (which decreases DIO), increasing payment terms with suppliers (which increases DPO), and shortening the time it takes to collect payments from customers (which shortens DSO). Generally, a lower CCC indicates better working capital efficiency.

Order-to-Cash Cycle (O2C)

Optimizing your O2C cycle is an opportunity to build a competitive advantage.

Optimizing your Order-to-Cash (OTC) cycle presents an opportunity to gain a competitive advantage. The current business environment has highlighted the importance of an optimized OTC cycle.

The OTC cycle encompasses processes and steps from when a customer orders to when the order is fully processed, fulfilled, and recorded. Overlooking the importance of the OTC cycle can lead to deficiencies and expose businesses to risks, impacting not only the finance department but also other functions such as supply chain and inventory management.

Take the lead in adopting a proactive OTC approach by anticipating actions and building an integrated process framework. Some common errors in the OTC cycle include:

- Failure to follow up on customers’ payments on time

- Overriding of credit limits by the sales department

- Absence of training on how to deal with late-paying customers

- Insufficient attention to the accuracy of the invoices or credit terms

How Does Working Capital Optimization Work?

Fintelligence Consultants have developed a robust Framework.

- The assessment uses qualitative and quantitative methods to focus on accounts payable, inventory, accounts receivable, and other working capital items. Invest in a working capital assessment today and take your business to the next level.

- It provides a roadmap recommending options for securing target benefits, such as greater visibility and predictability of cash flows, cash improvements, reduction in net working capital, and post-assessment options to realize identified opportunities.

- Our assessment provides a roadmap recommending options for securing target benefits, which can go beyond quick wins and short-term improvements. How to improve Cash cycles (DSO, DPO, DIO).

- For instance, you may gain greater visibility and predictability of cash flows, cash improvements of 5%-10% of annual revenues, 20%-25% of net working capital, and post-assessment options to realize identified opportunities. Take advantage of the chance to optimize your working capital structure and take your business to the next level. Invest in a working capital assessment today.

Working Capital Assessment

- Working Capital Assessment:- Comprehensive analysis of working capital requirement and CCC

- Accounts Receivable Management:- Accounts Receivable processes targeting DSO improvement

- Inventory Management:- Enhance Demand Forecasting and manage inventory cost vs. customer delivery.

- Accounts Payable Optimization:- Identify opportunities for improved payment terms vs. vendor relationships.

- Cash Flow Forecasting:- Cash Flow Forecasting Model, Monitoring and Management.

- Internal Control:- Policy and Automation drives process improvement and enhance efficiency

- Performance Metrics and Monitoring:- KPI to track, measure, and monitor the performance

- Implementation Plan:- Our proposal includes a detailed roadmap for implementing the recommended changes. We will collaborate closely with your team to ensure a seamless execution.

- Continuous Improvement:- Working capital management is an ongoing process. We will work with you to instill a culture of continuous improvement within your organization to sustain and build upon the gains achieved."

A prerequisite for a permanent reduction in working capital is systematic analysis and identification of structural drivers and causes of the high working capital levels.

- A business’s processes and structures (such as decentralized inventory management and poor incentives)

- Corporate strategy, internal policy, and accountability culture

- Monitoring and control systems (e.g., the failure to use ratios concerning working capital)

- Automation of Order-to-Cash process.

What is the recommended way to generate positive Cash Flow?

Cash Flow Management

- Efficient cash flow management to ensure a business's smooth operation.

- Optimal cash balances to meet its short-term obligations.

- Invest any extra cash in securities with the best returns, considering liquidity and default- risk constraints.

- Strive to manage A/R effectively to ensure timely payments and appropriate inventory levels.

- Ensure you have the appropriate amount of efficient and adaptable short-term financing.

- Achieve the shortest possible Cash Conversion Cycle (CCC = DSO + DIO—DPO).

Unlock tied Working Capital

- Improve working capital and cash flow to enhance liquidity for accelerated business growth.

- Optimizing working capital unlocks an average of 20 - 30% of the funds tied up and pays back within a few months.

Cash Flow Forecast

- Use 13-week rolling cash flow forecasts.

- Analyze cash flow variances weekly.

- Engage with financiers early to address forecasted deficiencies.

- Nurture “Cash fit” culture.

Valuation

Fundamental Principles of Value Creation

- Companies aim to create value for their owners by investing money now to generate more cash flows and earnings in the future. The value they make is the difference between the cash inflows and the cost of investments, adjusted to reflect that future cash flows are worth less than today's due to the time value of money and the riskiness of future cash flows.

- A crucial aspect of business is creating value, which is determined by a company's return on invested capital (ROIC) and revenue growth. These govern the conversion of revenues into cash flows and earnings. The amount of value a company creates is ultimately determined by its ROIC, revenue growth, and ability to sustain both over time through reinvestment.

- It's important to note that a company will only create value if its ROIC exceeds its cost of capital. Additionally, growth will only increase a company's value if ROIC exceeds the cost of capital. Growth at lower returns reduces a company's value.

Revenue Growth

- Growth only creates value if the new customers, projects, or acquisitions generate higher returns on invested capital (ROICs) than the cost.

- Revenue Growth Divers

- Portfolio momentum- the organic revenue growth due to the market expansion.

- Market share performance: in any particular market.

- Acquisitions (M&A): inorganic growth through acquisitions or divestments.

- High-ROIC companies usually generate more value by focusing on growth, whereas lower- ROIC companies can increase their value by improving their ROIC.

- Revenue growth is needed to create value. The key is to generate a high value per dollar of additional revenue, which depends on the market competition level.

- Genuine product innovation is the growth strategy with the highest potential, as new product categories have no established competition.

- Similarly, attracting new customers or increasing sales from existing customers can create substantial value, as direct competitors tend to benefit.

- Bolt-on acquisitions can also add value as they can boost revenue growth with little additional cost and complexity.

- However, revenue growth through market share gains is less attractive, as it comes at the expense of established, direct competitors who are likely to retaliate, especially in mature markets.

Reinvestment, a Growth Driver

- The correlation between investment and growth is even more apparent in the world’s emerging economies, which achieve more than twice the average economic growth with almost twice the capital intensity.

- Not only is investment critical at the national level, but getting investments right at the company level can make an enormous difference to a company’s value creation.

- To achieve superior profitability, companies must choose strategies that build competitive advantages and mitigate or alter the pressure of competitive forces.

- Investing in products, production capacity, distribution channels, and R&D is driven by customer demands and is an investment in customers.

- By viewing customers as an investment, companies move customer issues from the P&L statement to the balance sheet, making them more strategic. This means that all investment decisions require the attention of executive committees and boards.

- Capacity Optimization focuses on efficiently using the company's production machinery. This portfolio aims to sell mainly products and doesn't prioritize adding services or value- added components to the core products. By optimizing capacity, the goal is to minimize costs and seek lower average costs.

- Reinvest in Cash Flow Maintenance aims to maintain cash flow by decreasing divergence. This helps the company keep cash flow while minimizing costs. Example,

- Reinvest as required to maintain cash flow in Base Business-Capex=D&A. Focus on replacement, not growth investments.

- Reinvest enough to maintain cash flow in Harvesting Business Capex<D&A. Only replacements and mandatory investments.

- Reinvest in Renewal and Growth, focusing on finding new revenue sources. Companies must continuously reinvent themselves to identify new business areas that cater to customers’ yet-to-be-articulated demands. Example,

- Reinvest selectively in the Development Business – Minimum Share of total investment. Allocation to most attractive opportunities.

- Reinvestment in Growth Business – Capex >D&A. limited only by the availability of attractive growth investments.

Cash Flow

- Focusing on the risk-adjusted cash flows that its existing and future businesses prospect is essential to maximizing a corporation's intrinsic value. This can be measured through discounted cash flow (DCF) analysis.

- Since Growth, ROIC, and Cash Flow are mathematically intertwined, a company's performance can be described using any of these variables.

- Creating value over time involves improving intrinsic value by increasing returns on existing capital, investing new capital to generate returns higher than the company's cost, or divesting unproductive capital.

Cost of Capital

- The cost of capital is a weighted average of the expenses (WACC) of raising funding for an investment or a business, with that funding taking the form of either debt or equity.

- The cost of equity will reflect the risk that equity investors see in the investment, and the cost of debt will reflect the default risk that lenders perceive from that investment.

- The weights on each component will reflect how much each source will be used to finance the investment, i.e., the debt-equity ratio.

- The cost of equity is calculated using a combination of the risk-free rate, Equity Risk Premium, relevant Industry Beta, and specific country risk premium.

- The cost of debt is calculated by interest rate discounted by corporate tax rate, as interest cost is tax-free.

Coaching and Competence Focus

Our unwavering focus on coaching and developing competence underscores our commitment to helping our clients achieve sustainable business results. We believe that meticulous execution and an unyielding dedication to improvement are paramount. We offer comprehensive supportive services to ensure our clients thrive, including personalized business coaching, tailored competency development, hands-on process support, adequate tool support, and customized mentoring. We aim to empower our clients to attain and maintain their desired outcomes, ensuring their long-term success and prosperity.

We have developed a module that considers business needs and executive working styles.

- We begin with Fundamental training in Budgeting and Forecasting, Profit opportunities, Cash flow and Working Capital, Re-Investment strategy, or capital budgeting. We measure and monitor performance management through Financial Analysis and Reporting and meet Board and management expectations.

- We added the necessary competency-building workshop, which included preparing internal policy and controls and understanding risk mitigations. All this leads to the basic foundation of governance. Thinking through the broader perspective of internal accountability and meeting external challenges is a valued competency.

- We offer tools to use, improve, and use for regular analysis and insights. Many times, different companies have specific requirements. We can guide your team in developing those tools. Tools built in Excel are an excellent beginning. Once the understanding and processes reach proficiency levels, automation, and software systems can enhance their value.

- During the assignment period, we encourage your team to take some initiatives and projects under our supervision. That will be an excellent chance to showcase and apply their recently enhanced competence to the company's requirements. We review their performance and guide them toward continuous improvement.

- We wish to take key personnel mentoring. We hope what we deliver to clients will be sustainable in the medium to long term. Many times, mentoring key personnel helps keep that momentum. We identify them as super users. Super users are responsible for mastering specific skill sets and internally training others. This is the benchmark method where the company can internalize the competence building without frequently hiring an external advisor.

How Do We Serve Our Clients?

Frequently Asked Questions

Financial Planning and AnalysisFP&A teams are pivotal in guiding financial resources toward your business’s most valuable activities. They deftly navigate between planning and execution, delve into strategy formulation and planning, and adeptly manage the uncertainties of transformative moves. Their strategic financial management significantly influences your organization’s direction and business goals, providing a reassuring hand on the helm of your business’s economic strategy.

The role of FP&A has transformed rapidly, emphasizing the importance of collaboration between finance and other business functions. Finance has transformed from a supporting role to a pivotal driver of business success, focusing on forecasting, management information, and new analytical tools. Strategic FP&A is crucial in building conviction around strategic moves and is responsible for business unit profit and loss.

Achieve Overall Financial Excellence. In the face of sustained market volatility, increasingly complex regulatory requirements, and growing pressure on margins, best-run organizations initiate best practices that enable them to excel.

- Performance from Plan to Action. Achieve corporate financial objectives that can create sustainable value.

- Cash and Liquidity Management. Funding business opportunities and make it sustainable by lowering financial risks.

- Execution of Finance Processes and Services: By improving the finance function’s efficiency, we can deliver superior service at a reduced cost.

- Accelerated Financial and Regulatory Reporting. Timely and accurate financial, management and regulatory reporting can be accelerated.

- Control of Compliance and Risk. Proactively manage enterprise risk and

compliance while maintaining profitability.

Robust and insightful Management information helps monitor the organization’s performance and make informed decisions about resource allocation. The FP & A function is critical in ensuring that management information is robust and insightful. The function can provide significant business value to an organization by combining financial and non- financial measures, value chain insights, and leveraging business drivers.

Frequently Asked Questions

Profit Maximization- Revenue enhancement drives top-line growth by addressing pricing that enables Gross Margin volume.

- Margin expansion through effective pricing management involves identifying cost-to- serve, benchmarking market pricing and competitors, and managing and passing on the inflationary pressure.

- Decreasing the COGS ratio through a tactical analysis of every expense and how these can be cut, optimized, and synergized.

- Cost optimization isn’t just about cutting expenses; it’s a strategic move that can lead to

higher returns and deter competitors. By operating at a low cost and increasing productivity, your business can gain a competitive edge in the market. - Sufficient operating leverage utilizes fixed costs to boost profitability by magnifying the impact of sales fluctuations.

Profit maximization, the ultimate goal of any business, is calculated by determining the point where marginal revenue equals marginal cost. At the core of profitability lies value creation in core activities. The EBITDA measure, often misunderstood, is a crucial indicator of this value creation. It focuses more on the investors, particularly Private Equity & M&A deals. EBITDA is not just a number; it reflects the core, operational, and embedded in daily business decisions that drive profitability. Understanding and effectively managing EBITDA can significantly enhance a business’s profitability and value.

Businesses can unlock significant growth potential by implementing sustainable profit improvement strategies, enhancing their value and shareholder return. This growth potential is often untapped, presenting a promising opportunity for companies.

Even highly profitable companies, despite their success, hold a wealth of untapped potential for further growth. When harnessed through a transactional approach to profitability and identifying its drivers, this growth potential can lead these companies on an exciting profit maximization journey. Properly implementing sustainable profit improvement activities can significantly enhance a business’s value and shareholder return.

The two principal routes to profitability optimization are revenue enhancement and margin expansion. Revenue enhancement involves pricing strategies, boosting demand through marketing, and creating new goods or services. Margin expansion includes reducing the COGS ratio, cost optimization, and effective operating leverage. Understanding these strategies is crucial for business professionals, as they play a key role in driving profitability and value creation.

Frequently Asked Questions

Cash Flow & Working CapitalCash. Managing a firm’s cash flow is not just a challenge but one of the most significant challenges financial managers face. The depletion of liquid resources can cause a firm to default on its maturing obligations as they come due, leading to a state of technical insolvency—an act of bankruptcy. This is a risk we cannot afford to overlook. Firms can run out of liquid financial resources in several ways. Rapid growth in production and sales can cause the firm to use up all of its cash, pursuing growth, leaving it invested in illiquid assets such as inventories, accounts receivable, and net fixed assets. The surprising thing about this state is that the firm may be highly profitable in an accounting sense but be on the verge of bankruptcy as it pursues uncontrolled growth in sales.

Working Capital. Adequate working capital is crucial to fund investments and financial stability in your business. To ensure your working capital works efficiently, you must clearly understand your cash flow, be prepared for economic downturns, perform well compared to your industry peers, and satisfy your customers and suppliers.

Businesses strive to optimize their working capital to extract liquidity trapped within the cash conversion cycle. The faster the cash conversion cycle, the quicker the cash flow. However, the elements of working capital, such as Accounts Receivable, Accounts Payable, and Inventory, need to be optimized and benchmarked through DSO, DPO, and DIO. That leads to an improved CCC cycle. Working capital elements can turn into illiquid assets if timely action is not taken.

Current assets and liabilities are the components of working capital. Accounts Receivable, Payable, and Inventory are the main elements driving the Cash Conversion Cycle. Working capital element performance is measured by Days Outstanding of Sales (DSO), Days Inventory outstanding (DIO), and Days Payable outstanding (DPO). The Cash conversion cycle (CCC) measures total working capital performance. The lower the cycle, the better the performance of turning cash into hand from the day of sales.

Working capital management is the weakest part of most companies, including MNCs. A focused approach, internal controls, policy, and top management support are critical. Moreover, an expert who understands and mitigates the risk in time can turn the situation around. In most turnaround situations, working capital is the priority.

Working capital management offers businesses a beacon of hope. Optimizing and shortening the cash conversion cycle can unlock an average of 20 – 30% of the funds tied up, providing a significant financial boost within a few months.

Current assets—accounts receivables and inventories—and accounts payable are the most critical factors in optimizing working capital. Typical problems are pressure on margins due to intensified competition in globalized markets, unsatisfactory cash flow performance in recent years, expensive acquisitions resulting in excessive debt and depressed profits, and a shortage of capital to finance growth.

The effects of Active Working Capital Management are a permanent reduction in funds tied up in working capital, unlocking capital for strategic investments, increasing profitability, optimizing business processes by identifying working capital drivers, and Protecting liquidity.

Improved Cash Flow and enhanced liquidity accelerate business growth. Managing a company’s cash conversion cycle (CCC) components can help improve its working capital. This includes reducing inventory levels (which decreases DIO), increasing payment terms with suppliers (which increases DPO), and shortening the time it takes to collect payments from customers (which shortens DSO). Generally, a lower CCC indicates better working capital efficiency.

The cash flow cycle plays a crucial role in understanding how a business operates, including where cash comes from, how it’s used to finance operations, how it’s recovered, and how it grows over time.