Business Plan

Bringing Your Business Ideas to Life, The business plan aims to minimize the risk associated with a new business and maximize the chances of success through research, feasibility, and planning.

A business plan is a document that outlines your thought process as you analyze your competition, market, expenses, staffing needs, manufacturing process, etc. It helps clarify goals and objectives. A successful business plan outlines your company’s opportunities and growth prospects and highlights the benefits it offers potential investors. It effectively communicates your company’s value, making it an attractive investment opportunity. From an external perspective, the business plan serves as your company’s primary financial tool. Moreover, a persuasive business plan can be crucial in securing important clientele.

Business Plan Constituents

The market includes existing and prospective clients, customers, and users of the planned product or service, investors, whether of financial or other resources, and producers, whether the entrepreneur or the inventor.

Business Plan Elements

Market Perspective

Investor Perspective

Investors tend to be cautious as fledgling companies often fail to meet their profit forecasts. A business plan with a focus on 3–5-year projections is crucial to attract investors. Investors calculate a company’s potential worth after 5 years to determine the percentage they own to realize their return, often 4.5X of their initial investment.

Objective

The central aim of the business plan is to evaluate feasibility and bring your business ideas to life. Moreover, craft and weave a compelling strategic narrative that captivates and engrosses potential investors, backed by a market-driven approach. Fintelligence Consultants assist you in not just aiming at a goal but also in ensuring execution.

How Do We Help?

Our business plan includes expert assessments of the industry’s structure and competitive landscape, a lucid presentation of the unique business model that sets us apart and illustrates the company’s revenue generation, insights into present and future operational enhancements, operating frameworks, and growth strategies. The plan also includes:

- Financial projections supporting the investment base case.

- Both optimistic and conservative scenarios.

- A transparent presentation of the business case's fundamental assumptions.

- Execution Perspective. The business plan outlines the steps for execution and the assumptions integral to achieving success. The execution of the plan relies on the organization's capabilities, including existing and potential capabilities. These capabilities are considered critical assumptions within the business plan.

How Can You Execute a Business Plan Effectively?

Basics of Successful Business Plan and Investment Strategy

- Analyze the investment case for at least five years.

- Consider strategic factors and competition.

- Eliminate excessively optimistic assumptions.

- Ensure realistic cash generation projections and practice effective cash management. This is a crucial aspect of financial planning that can improve your business’s success.

- Private equity investments may reduce management forecasts by 20% in projected EBITDA.

Achieve Operational and Financial Efficiency

To improve the bottom line and generate cash, focus on these activities: better governance and reporting, promoting management accountability, reducing operational complexity, optimizing head office and central functions, cutting operational costs, reducing waste, improving working capital efficiency, asset disposals, eliminating inefficient CAPEX spend, and focusing on cash generation. These should be achieved within the first 6-18 months of private equity ownership.

Optimize Existing Customer Value Proposition

Maximizing product portfolio sustainability and profitability includes improving product perception, reducing customer churn, and eliminating uneconomic product-related activities. To optimize the revenue model, the company should prioritize addressing two or three fixable weaknesses in the customer proposition within the first 24 months. Revenue growth is the primary source of value creation, accounting for 70% of total value in private equity deals.

Pursue Profitable Growth

How Do Our Clients Benefit From Our Services?

Our Financial Planning and Analysis expertise is a foundation for preparing a solid business plan. We take care of the financial foundation that addresses the need for funding, a prerequisite for business growth, whether you raise it through retained earnings or external funding.

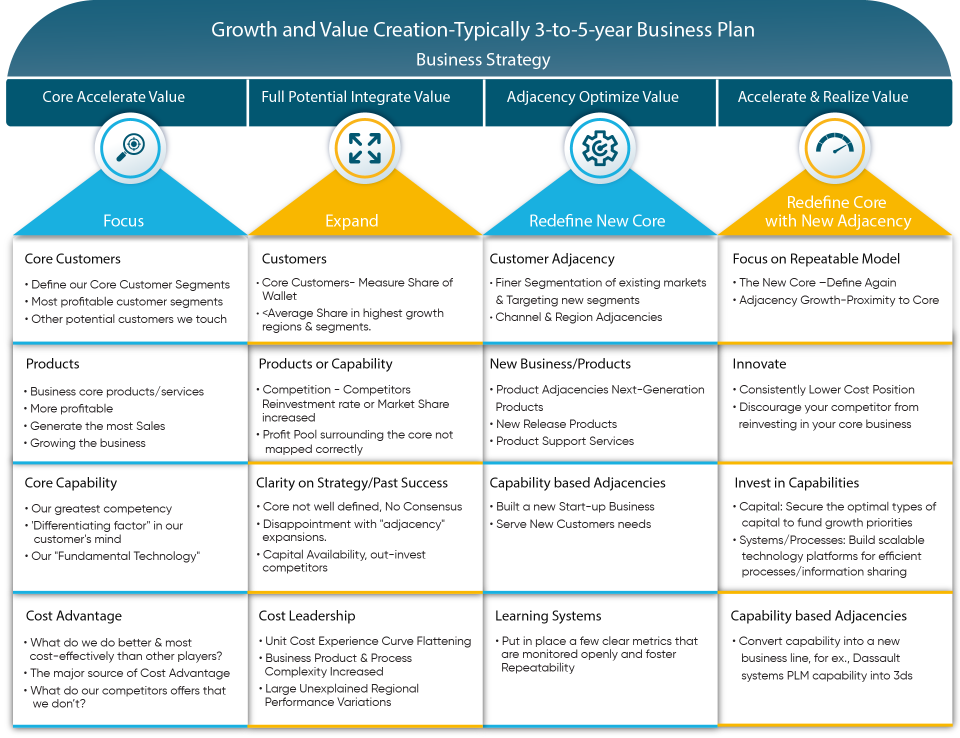

A business plan is an effective tool for creating value. Typically, a 3-5 year plan can incorporate stepwise value creation. This is an ideal period for the company to sustain growth momentum and develop the capabilities required for the future.

Why Choose Us?

Market Perspective

Financial Perspective

Investor Perspective

Execution Perspective

Coaching and Competence Focus

We have developed a module that considers business needs and executive working styles.

- We begin with Fundamental training in Business Planning, Financial planning and analysis, Budgeting and Forecasting, and Finance for non-finance.

- We added the necessary competency-building workshop in sales and customer analytics, customer strategy, Customer lifetime value (CLV), pricing strategy, and service portfolio strategy. Commercial excellence is the surest way to execute the business plan. It improves the chances of customer retention and repeat business. All this leads to a responsive sales and marketing function.

- We offer tools to use, improve, and use for regular analysis and insights. Many times, different companies have specific requirements. We can guide your team in developing those tools. Tools built in Excel are an excellent beginning. Once the understanding and processes reach proficiency levels, automation, and software systems can enhance their value.

- During the assignment, we encourage your team to take some initiatives and projects under our supervision. That will be an excellent chance to showcase and apply their recently enhanced competence to the company's requirements. We review their performance and guide them toward continuous improvement.

- We wish to take key personnel mentoring. We hope what we deliver to clients will be sustainable in the medium to long term. Many times, mentoring key personnel helps keep that momentum. We identify them as super users. Super users are responsible for mastering specific skill sets and internally training others. This is the benchmark method where the company can internalize the competence building without frequently hiring an external advisor.

How Do We Serve Our Clients?

Frequently Asked Questions

A business plan is an indispensable written document that unveils a detailed description and overview of your company’s future. It is paramount for all businesses to craft a comprehensive business plan meticulously. This plan should compellingly expound upon your business strategy and the key initiatives that will drive the journey from the present state to the desired future state of the business.

Ensuring a high-quality business plan to secure investment funds is essential to attract investors. Entrepreneurs must focus on meeting the needs of marketers and investors. This can be achieved by demonstrating customer interest, showing a viable market, and providing accurate financial projections. It’s important to note that investors prefer market- driven companies over those that solely focus on technology or services. Additionally, investors are interested in understanding your plan for exiting or cashing out and the expected price or valuation. As investors have a short attention span, they appreciate a clear path to a return on their investment, compounded and adjusted for inflation. Addressing these concerns makes investors feel valued and integral to the business plan.”

Investors expect a high-quality plan demonstrating customer interest, a viable market, and accurate financial projections. They prefer market-driven companies and want to understand the exit strategy and expected valuation. Providing a clear path to a return on investment makes investors feel valued and integral to the business plan.

A business plan is a crucial tool for startups and established businesses. For startups, a well-crafted business plan is essential for attracting potential lenders and investors. At the same time, established companies use business plans to remain on course and aligned with their growth objectives. Additionally, established businesses often develop new business concepts, create business plans, and launch and expand to capitalize on new opportunities. When considering entry into a new market, launching a new product/service, growing into a new country, or diversifying, businesses must reconsider their strategies. Any business outside its core and adjacent areas functions like a startup business.