Business Advisory

Increase Revenue or Stalled Growth

Turnaround Situation

Investment Options

Capacity expansion, acquiring a new business, and building new infrastructure are critical for company growth. We can address constraints using NPV analysis, evaluating cash flows, and considering the cost of capital. Evaluating external factors like competitor responses, investment opportunities, and timing is also important.

Fundraising Options

Resolve Funding Situation, Attract Investors

Profit Maximization or Declining Profit

In profit improvement cases, the critical issues typically revolve around the three C’s: costs, customers, and competitors, all interconnected through the profitability equation. We implement price discipline, cost optimization, cross-selling, and upselling measures to increase sales volume and realign sales focus.

Objective

What Challenge(s) do Our Clients Face?

Businesses must focus on what they can influence by adopting management practices. A deeper understanding of internal constraints and strengths helps overcome the situation. Volume, Price, Niche markets, and a combination of variable and fixed costs are some elements that can improve the situation.

- Declining sales in a particular product or region?

- Why is the Growth rate consistently below market growth?

- Competitors can achieve good growth. What are they doing differently than us?

- Do we need to take significant actions to increase revenue and reduce costs?

- What is the best mix of Volume, Price, and Cost that delivers profitable growth?

- What has volume been over time? Do we have it by product wise? What are the reasons for the change?

- How have prices changed over time? Why are they constants? What are the risks of price changes? What are the expected trade-offs between volume and price?

- Are there niche markets where we undersell or do not sell? Do we have the skills to reach these customers? How long will it take to mobilize and begin selling?

- Are there obvious variable costs that can be reduced? Which variable costs will be more complex to reduce? What variable cost reductions have been made thus so far?

- Are there any fixed costs (e.g., lease) where the contract is almost complete? Are there any fixed costs we can slow (e.g., replacing equipment) or eliminate?

How Do We Help?

Fintelligence Consultants developed the toolkit for evaluating your business’s feasibility, market assessments, expansion matrices, and our unique interpretations of different frameworks. These interpretations result from our innovative approach to business analysis, which combines traditional frameworks with our insights and experiences, providing you with unique and valuable insights. We use these tools to comprehensively analyze your business, identifying areas of strength and weakness, potential growth opportunities, and strategies for improving your competitive position.

This strategic approach will address stagnant growth and increase revenue, profit maximization, and a sustainable competitive position in your industry. It will ensure a significant positive impact on your bottom line and instill a sense of optimism about the potential outcomes of our service.

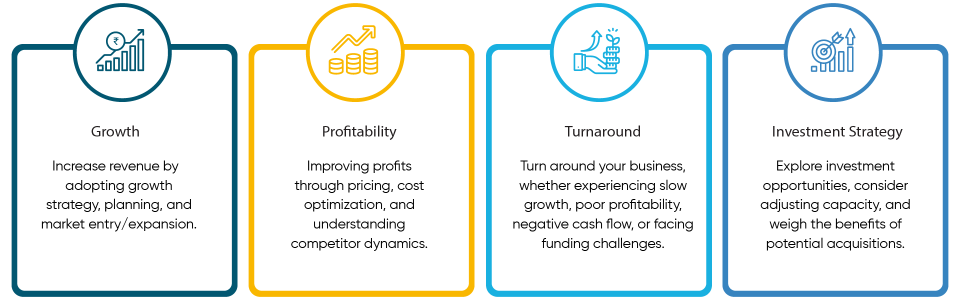

- Increase Revenue by adopting Growth Strategy/ Planning and Market Entry/Expansion.

- Profit improvement through Pricing, Cost optimization, and Competitor Dynamics.

- Evaluate Investment options, including Capacity adjustment and Acquisitions.

- Improve funding opportunities by attracting investors and lenders through Governance and generating positive cash flow.

Business Advisory Services

Are you facing unique business challenges that seem to prolong your business growth? Our tailored solutions can help you turn things around, improve efficiency, and address issues like business growth plateaus and profitable expansion.

How We Can Help:

We’re all about turning things around with maximum efficiency and practicality. Our framework ensures that every decision is well-informed and aligned with your strategic objectives. We’re committed to providing compreshensive support and guidance to prove the way for your success. We’re confident your company can benefit from our services and achieve similarly impressive results!

What are the Benefits of Business Advisory Services?

Growth Strategy

- Market Penetration

- Market Expansion/Entry

- New Product Development

Profit Maximization

- Pricing Optimization

- Industry Landscape & Competitor Dynamics

Cost Optimization

- Also, part of the Profit Maximization Scenario

Turnaround

- Turning around sick business, unprofitable growth, stalled growth

Investment Options

- Evaluating the potential capacity expansion, purchase of a new business, or installation of new infrastructure

M&A and Diversification

- M&A Strategy targeting Increasing Market Share, Widening Product Portfolio, Avoiding Potential Competitive Threat

- Diversification opportunities

Company Situation Analysis

It aims to disclose all opportunities (capacity) and the risks inherent in the environment and assess the competitiveness of the company’s resources and existing market position.

Environmental Analysis

Environmental Analysis studying the political, economic, social, and technological factors that may affect the company’s performance and minimize risks that help to capitalize on business opportunities.

Market Analysis

Market Analysis involves delving into current market trends, competitive landscapes, customer needs and preferences, and market conditions. It also encompasses assessing the potential for growth, identifying opportunities for improvement, and formulating strategies to capitalize on them.

Strategic Analysis

Strategic Analysis aims to identify and analyze the company’s strategic goals and objectives and develop strategies to achieve them. It focuses on the company’s strategic environment, competitive advantages, and disadvantages, which helps strategy formulation maximize and minimize weaknesses.

Organizational Analysis

Organizational Analysis involves the organization’s internal structure and functioning, relationships with external stakeholders, and internal processes and systems that guide the organization in the SWOT and weakness and formulate strategies to improve the organization’s performance.

Financial Analysis

Financial Analysis focuses on analyzing a company’s financial health, such as its financial statements, ratios, and trends, to formulate strategies to improve its profitability and balance sheet.

The analysis focuses on how the company is performing historically and to make necessary adjustments if your plan is not yielding the expected results.

- Company: Evaluate vision, strategy, performance, and competitiveness.

- Product and Services: Analyze current and future offerings and seek customer feedback.

- Market Analysis: Understand the target market and distribution channels.

- Opportunities: Identify unmet market needs and conduct a SWOT analysis.

- Customer Analysis: Research customer demographics and preferences.

- Competitors: Analyze main competitors and their advantages.

- Collaborators: Evaluate partnerships and supplier relationships.

- Business Environment: Conduct a PESTLE analysis of external factors.

When do Businesses Seek Business Advisory Services?

Business Needs Advisory/ Consulting: Some signs to call the Advisory.

- Stagnant Growth or Declining Performance - Consultants can identify the causes and provide solutions.

- Lack of Expertise - A specialist can enhance your company's performance.

- Change Management: Provide valuable insights into potential changes and the transition journey and ensure the success of the process.

- Preparation for Expansion, Merger, Diversification, and Exit—Help identify risks and opportunities and ensure expansion and integration.

- Introduction of New Technologies – Implementing new technologies and optimizing for your business

Why Choose Us?

Strategy and Finance are interconnected. We believe in integrated solutions. Strategic investments require investment, and the financial result is the crucial outcome of any strategy.

Strategic and Business Planning

- A strategic plan is focused on mid to long-term goals and explains the primary strategies for achieving them.

- A business plan is short- or mid-term goals defining the necessary steps.

Financial Planning

- FP&A will steer the company toward its strategic goals, including revenue growth, profitability, and cash flow.

- A Finance Business Partner collaborates & provides guidance for decision-making, insights & evaluating performance using various tools.

Operations Planning

- A roadmap to align to a strategic plan & outlines timelines, & critical milestones for execution.

- Transition from strategic to operational plan by converting it into an annual plan and further at monthly and weekly intervals to drive execution.

Coaching and Competence Focus

We have developed a module that considers business needs and executive working styles.

- We offer tools to use, improve, and use for regular analysis and insights. Many times, different companies have specific requirements. We can guide your team in developing those tools. Tools built in Excel are an excellent beginning. Once the understanding and processes reach proficiency levels, automation, and software systems can enhance their value.

- During the assignment, we encourage your team to take some initiatives and projects under our supervision. That will be an excellent chance to showcase and apply their recently enhanced competence to the company's requirements. We review their performance and guide them toward continuous improvement.

- We wish to take key personnel mentoring. We hope what we deliver to clients will be sustainable in the medium to long term. Many times, mentoring key personnel helps keep that momentum. We identify them as super users. Super users are responsible for mastering specific skill sets and internally training others. This is the benchmark method where the company can internalize the competence building without frequently hiring an external advisor.

Frequently Asked Questions

Every company encounters a growth gap – a misalignment between its intended path and business capabilities. Business advisors bring experience and specialized knowledge to the table. They can pinpoint the underlying causes and offer practical solutions. An advisor can boost your company’s performance, offer valuable insights for potential changes and the transition journey, and guarantee the success of the process.

Small businesses face the challenge of being consumed by day-to-day operations, which can hinder their ability to focus on long-term growth and strategy. Business advisors offer personalized, incremental solutions to help small businesses improve their capabilities and free the entrepreneur to concentrate on business opportunities. In many cases, the benefits of advisory services outweigh the associated fees.

Business advisory services help businesses improve their current condition, but the future state also depends on the internal team’s competency and execution. Advisors help monitor progress by guiding the company to reach its goal.

Example 1: Business planning is a crucial part of business growth. Many companies need to pay more attention to this fundamental aspect because they need more expertise, competency, and comprehensive knowledge.

Example 2: Cash flow is the lifeblood of any business. Effectively managing working capital is critical. However, many companies need help to establish internal credit policies and controls. Advisors develop and implement plans for policies, execution, monitoring, reporting, and continuous improvement.

The cost of Business Advisory Services can vary based on the specific needs of your business and the amount of time and resources required to provide the service. Your advisor can assure you that the value you receive will exceed the fees you pay.